lu-st.ru

Tools

Best Car Lenders For Bad Credit

Applying for subprime auto loans with RoadLoans We believe car loans for people with bad credit should be simple and hassle-free. RoadLoans accepts. We're a bad credit car dealer in LaFayette, GA, here to serve customers from Chattanooga and rural Georgia as they deal with poor credit. Compare rates with lenders that offer car loans for bad credit ; Autopay: Best for comparing loan offers. We can help you get approved for a car loan, even if you have bad credit or no credit. Learn more from Preston Hood Chevrolet, Inc. in Fort Walton Beach. From our extensive research, we found the best car loans for bad credit are offered by myAutoloan, Ally, AutoPay, Prestige Financial, Capital One, Carvana. No matter what your financial situation is, the credit experts at Larry H. Miller Toyota Corona can help you get a car loan, whether you have bad credit or. Car loans for bad credit can help rebuild your credit and get you back on track. A Greater Nevada Credit Union car loan for bad credit can be the first step. Arlington Toyota works with good, bad, and even no credit every single day. We don't just look at your credit score—we look at your entire situation as it. Fortunately, Germain Toyota of Columbus maintains close relationships with a variety of banks and specialized credit unions, meaning we can arrange a great car. Applying for subprime auto loans with RoadLoans We believe car loans for people with bad credit should be simple and hassle-free. RoadLoans accepts. We're a bad credit car dealer in LaFayette, GA, here to serve customers from Chattanooga and rural Georgia as they deal with poor credit. Compare rates with lenders that offer car loans for bad credit ; Autopay: Best for comparing loan offers. We can help you get approved for a car loan, even if you have bad credit or no credit. Learn more from Preston Hood Chevrolet, Inc. in Fort Walton Beach. From our extensive research, we found the best car loans for bad credit are offered by myAutoloan, Ally, AutoPay, Prestige Financial, Capital One, Carvana. No matter what your financial situation is, the credit experts at Larry H. Miller Toyota Corona can help you get a car loan, whether you have bad credit or. Car loans for bad credit can help rebuild your credit and get you back on track. A Greater Nevada Credit Union car loan for bad credit can be the first step. Arlington Toyota works with good, bad, and even no credit every single day. We don't just look at your credit score—we look at your entire situation as it. Fortunately, Germain Toyota of Columbus maintains close relationships with a variety of banks and specialized credit unions, meaning we can arrange a great car.

Guaranteed Credit Approval · Bad Credit Car Loans Sterling Heights. Concerned your credit might not be enough to get you approved for an auto loan? · A. Auto Credit Express works with a network of car dealers throughout the US to help bad credit car buyers find a loan. Most dealers can arrange bad credit auto. Yark has helped many drivers from all over the Toledo, Sylvania, Maumee, Oregon, Perrysburg, Bedford, and Bowling Green areas secure a car loan despite their. Types of lenders that offer car loans for bad credit · Banks and credit unions, known as direct lenders, are a good place to start. · Online loan marketplaces. I forgot about this but you can try the Capital One Auto Navigator and they'll prequalify you for a certain amount. Not a hard credit check. We selected the best auto loans for borrowers with bad credit based on interest rates, terms, transparency, and flexible eligibility requirements. Have bad credit? No problem! Henna Chevrolet Austin's finance center in TX, TX offers bad credit financing for all drivers in the nearby Round Rock and San. Your credit approval. Do you have bad credit and are looking for a car loan with guaranteed approval? Credit Acceptance empowers car dealers nationwide to help. These loans are often known as second-chance or subprime car loans. While not all lenders provide options for bad credit borrowers, Len Stoler Hyundai is an. Looking for no money down, bad credit auto financing? Oxmoor Mazda can help! We're Louisville KY's #1 destination for car loans with low credit scores! Jeff Belzer's Fresh Start auto program specializes in getting EVERYONE financing on NEW and USED vehicles. Everyone is approved! We offer auto loan financing. BECU and TapCo will work with a borrower with less than stellar credit. Avoid banks like the plague. FIX Your Bad Credit Score! Credit Union Car Loans for Bad Credit! Truliant has GREAT used car loans for bad credit Low interest car loans In simple terms, if you have a low credit score (minimum credit score is typically around FICO score), you transfer the qualifying title to the auto. We'll start by helping you find a new or used car you can afford. Then we'll get you pre-qualified for the best car loan we can find or find you sub-prime. Our dedicated team is here to understand your unique circumstances and find the best solution, offering flexible loan options for a variety of dependable car. Hyundai of Greeley offers auto loans for individuals with bad credit. Don't let your credit score stop you from owning a Hyundai. At Community Motors, LLC, we help our clients find Car Finance for Bad Credit in Myrtle Beach's metropolitan area and beyond. Get the best opinion from our team. Whether you have good credit, bad credit or no credit history at all, come to Barbera Autoland for subprime car financing, zero down and more. Buying a car can be an exciting experience, but you may find it difficult to get an auto loan if you have an unfavorable credit score.

Hartz Flea Collar Kills Cats

Since grooming is a natural instinct, all Hartz flea and tick products are formulated with this in mind. If used as directed, no problems should occur if your. HUG Plus collars for Cats provide seven months of protection for your cat · These collars prevent flea eggs from hatching, kills fleas quickly and offers full. Hartz® UltraGuard™ Flea & Tick Collar for Cats and Kittens kills both fleas and ticks for 7 months. This reflecting flea tick collar is water resistant. They were infested with fleas, so I got some Hartz flea & tick spray. My vet's secretary had a flea collar on her cat and it's jaw became paralized in Kills: fleas, ticks for up to 7 months. White collar. Break-away collar. Easy activation. Ingredients. Active ingredient: Tetrachlorvinphos (%), Other. Kills: fleas, ticks for up to 7 months. Water resistant. Break-away collar. Brand. Hartz. Assembled Product Weight. I used a Hartz flea collar on my cat, Smokey, when he was 15 weeks old. He developed a giant gaping wound around his neck. I used a Hartz flea collar on my cat, Smokey, when he was 15 weeks old. He developed a giant gaping wound around his neck. Fresh scented; Kills and repels fleas, ticks, flea eggs and flea larvae, plus prevents flea eggs from hatching for a 7 month duration. Since grooming is a natural instinct, all Hartz flea and tick products are formulated with this in mind. If used as directed, no problems should occur if your. HUG Plus collars for Cats provide seven months of protection for your cat · These collars prevent flea eggs from hatching, kills fleas quickly and offers full. Hartz® UltraGuard™ Flea & Tick Collar for Cats and Kittens kills both fleas and ticks for 7 months. This reflecting flea tick collar is water resistant. They were infested with fleas, so I got some Hartz flea & tick spray. My vet's secretary had a flea collar on her cat and it's jaw became paralized in Kills: fleas, ticks for up to 7 months. White collar. Break-away collar. Easy activation. Ingredients. Active ingredient: Tetrachlorvinphos (%), Other. Kills: fleas, ticks for up to 7 months. Water resistant. Break-away collar. Brand. Hartz. Assembled Product Weight. I used a Hartz flea collar on my cat, Smokey, when he was 15 weeks old. He developed a giant gaping wound around his neck. I used a Hartz flea collar on my cat, Smokey, when he was 15 weeks old. He developed a giant gaping wound around his neck. Fresh scented; Kills and repels fleas, ticks, flea eggs and flea larvae, plus prevents flea eggs from hatching for a 7 month duration.

This collar is intended for use only as an insecticide/IGR generator. The collar will begin to kill fleas, ticks and flea eggs and larvae immediately. This fresh scented, white collar kills and repels fleas and ticks for 7 months. The water resistant design remains effective even after getting caught in the. HUG Plus collars for Cats provide seven months of protection for your cat · These collars prevent flea eggs from hatching, kills fleas quickly and offers full. This collar kills and repels both fleas and ticks for seven months and also prevents flea eggs from hatching for over half the year. Hartz flea and tick products are commonly known to cause damage to the liver, heart, nerve system, and even death to dogs and cats. These stories are not. Collar for Cats & Kittens. This break-away collar helps kill fleas and ticks and offers full body protection for 7 months. It is effective in safeguarding your. Hartz UltraGuard Plus Flea and Tick Collar for Cats and Kittens kills and repels both fleas and ticks for seven months plus it kills and prevents flea eggs. Hartz UltraGuard Plus flea and tick collar for cats & kittens kills & repels fleas, ticks, flea eggs & flea larvae. Prevents flea eggs from hatching. Product Details · Kills and repels fleas and ticks, plus prevents flea eggs from hatching for 7 months. Can be worn simultaneously with your cat's regular collar. The collar kills ticks for 5 months and aids in their control an additional 2 months. Under conditions where cats are exposed to severe flea and tick. And guess what? It did not work very well at all - my husband had to pull ticks off my cats, and my dogs. No more! I'm not pulling ticks. They NEVER get fleas. FULL BODY PEST PROTECTION: Kills fleas, ticks, flea eggs and flea larvae and prevents flea eggs from hatching. QUICK SECURE APPLICATION: Long-tapered end is. Kills fleas and ticks,Reflects oncoming headlights up to m away,Lasts for 5 months,For cats and kittens. Kills Fleas. Kills Ticks. Full Body Protection. Break-Away Collar. Water Resistant. Fresh Scent. Net Contents: 1 Collar, Net Wt. OZ (15g). Kills and repels fleas and ticks for 7 months. The water resistant design remains effective even after getting caught in the rain. Kills and repels both fleas and ticks for 7 months, plus prevents flea eggs from hatching for 7 months, thereby stopping the flea life cycle and preventing. Kills: fleas, ticks for up to 7 months. Water resistant. Break-away collar. Ingredients. Active Ingredient: Tetrachlorvinphos %. Other ingredients . Kills flea larvae. Kills & repels. Fleas. Ticks. Flea eggs. Flea larvae. Prevents. Flea eggs from hatching. Full body protection. 7 month. Hartz® UltraGuard™ Flea & Tick Collar for Cats and Kittens kills fleas & ticks for 7 months. A cat flea and tick collar for use with cats and kittens. Water resistant. Kills fleas. Kills ticks. Full body protection. 7 month protection. Break-away collar. Reflects direct light up to feet.

How To Start A Personal 401k

It's time to start your own (k) or similar retirement savings program. The route you take will depend on your situation. How to Set Up a Solo (k) Plan For small business owners who meet certain requirements, most financial institutions that offer retirement plan products have. Here are all the documents you'll need to set up your plan. Note: To establish your plan, you will need an Employer Identification Number (EIN) or a Social. An Individual(k)—also known as Individual (k)—maximizes retirement You can open a SEP-IRA at Vanguard if there is only one person. Give us a. Open an Individual k at T. Rowe Price today. Take advantage of generous contribution limits and start saving more for your financial future. Yes. Generally, each self-employed partner will be able to open a separate Individual (k) plan. Get answers to commonly asked questions about One Participant (k) plans (also known as Solo (k), Solo-k, Uni-k and One-participant k). Get an employer identification number (EIN): You'll need an EIN to open a solo (k), so if you don't already have one, that should be your first course of. Many administrators allow you to open a self-employed (k) online. To set one up, you will need an Employer Identification Number (EIN), which you can get. It's time to start your own (k) or similar retirement savings program. The route you take will depend on your situation. How to Set Up a Solo (k) Plan For small business owners who meet certain requirements, most financial institutions that offer retirement plan products have. Here are all the documents you'll need to set up your plan. Note: To establish your plan, you will need an Employer Identification Number (EIN) or a Social. An Individual(k)—also known as Individual (k)—maximizes retirement You can open a SEP-IRA at Vanguard if there is only one person. Give us a. Open an Individual k at T. Rowe Price today. Take advantage of generous contribution limits and start saving more for your financial future. Yes. Generally, each self-employed partner will be able to open a separate Individual (k) plan. Get answers to commonly asked questions about One Participant (k) plans (also known as Solo (k), Solo-k, Uni-k and One-participant k). Get an employer identification number (EIN): You'll need an EIN to open a solo (k), so if you don't already have one, that should be your first course of. Many administrators allow you to open a self-employed (k) online. To set one up, you will need an Employer Identification Number (EIN), which you can get.

Yes, you can. An Individual (k) is designed for a business owner without W-2 employees and, if married, the owner's spouse. This applies to contractors. When a Solo (k) is referred to as a self-directed account, it simply means you can use the account to invest in areas outside of traditional stocks and bonds. As a sole business owner, a Solo (k) allows you to pay yourself up to $66, as both an employee and an employer. Running your own business is like running. How to Open a Solo (k). Opening a Solo (k) is pretty simple. Many online brokerages provide Solo (k)s in their menu of account offerings. All you'll. To fully establish your plan, you'll also need to complete the self-employed (k) account application, adoption agreement and trust agreement. Please keep. Solo (k) plans allow self-employed business owners to increase their retirement savings contributions versus an IRA. Secure your retirement with unlimited investment options, high contribution limits, and ultimate flexibility. Get Started. As a sole proprietor or freelancer you can open an SEk and Roth SEk. You will have the same maximum employer contribution as a regular. For taxable years and beyond, individual (k) plans may be set up by tax filing deadlines plus extensions. · Salary deferral portion of the contribution. Owner-only or self-employed (k) plans are designed for business owners Any business with no employees other than owners and their spouses can set up. To start, you'll typically need to fill out an application form provided by the Solo (k) provider. This form will ask for basic personal. You will fund your Solo K by making an initial tax-deductible contribution or by transferring funds from one or more of your existing retirement accounts or. If your company doesn't offer a (k) plan or you are self-employed, you'll need to join a separate financial institution. There you'll be able to open a (k). This (k) plan allows one-person business owners (and their spouse working for the business) the opportunity to save even more for their retirement. Individual or solo (k). A solo (k) is intended for sole proprietors and other small businesses who have no employees other than a spouse. Through a. Set up the SEP plan for a year as late as the due date (including extensions) of your income tax return for that year. (k) plan. Make annual salary deferrals. How to Set Up a (k) Plan for Your Business · Select the Plan Design that Best Fits Your Needs. · Pick a Provider with Low Fund Expenses and Purchase Your Plan. Yes. Generally, each self-employed partner will be able to open a separate Individual (k) plan. A self-employed (k), also known as a solo (k), can be an option for maximizing retirement savings even if you're not making a lot of money. Who can open. Step 1: Open your Solo k with Nabers Group · Step 2: Fund your Solo k · Step 3: Open a Depository Account for Your k Funds · Step 4: Start Investing.

How Is Progressive Home Insurance

Homeowners insurance typically covers your dwelling, other structures on your property, personal property, personal liability, medical payments to others, and. In addition to the bundle discount for both your auto and home with Progressive, there are also additional discounts if your home is a new purchase, if you pay. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). Through an agent · Get a quote · Or, call Learn more about home insurance policies. Home business insurance is coverage tailored to protect home businesses and their owners. It's important to remember that renters and homeowners insurance doesn. Progressive customers save an average of 7% when you bundle home and auto insurance with Progressive (savings applied on your auto policy). You also have the. Contact a licensed home insurance representative by calling Or, quote online with our HomeQuote Explorer tool. Email or fax proof of insurance. Make payments and manage automatic deductions. Submit claims and monitor status with real-time updates. Learn about policy. Contact a licensed home insurance representative by calling Or, quote online with our HomeQuote Explorer tool. Homeowners insurance typically covers your dwelling, other structures on your property, personal property, personal liability, medical payments to others, and. In addition to the bundle discount for both your auto and home with Progressive, there are also additional discounts if your home is a new purchase, if you pay. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). Through an agent · Get a quote · Or, call Learn more about home insurance policies. Home business insurance is coverage tailored to protect home businesses and their owners. It's important to remember that renters and homeowners insurance doesn. Progressive customers save an average of 7% when you bundle home and auto insurance with Progressive (savings applied on your auto policy). You also have the. Contact a licensed home insurance representative by calling Or, quote online with our HomeQuote Explorer tool. Email or fax proof of insurance. Make payments and manage automatic deductions. Submit claims and monitor status with real-time updates. Learn about policy. Contact a licensed home insurance representative by calling Or, quote online with our HomeQuote Explorer tool.

Review: Progressive earned average to below average scores in our sub-ratings, with the exception of homeowners insurance value, where despite its comparatively. Progressive customers save an average of 7% when you bundle home and auto insurance with Progressive (savings applied on your auto policy). You also have the. Progressive homeowners policies in North Carolina had an average monthly price of $ or $1, annually in Your rate could be higher or lower. Progressive Insurance offers coverage for cars, motorcycles, boats, RVs, and commercial vehicles. Progressive also offers homeowners insurance, but only through. Learn more about the different types of homeowners insurance, condo insurance and renters insurance policies to find out which is best for you. ASI Progressive Insurance · PROGRESSIVE® is the 3rd largest Property and Casualty Insurer and ranks 99th on the Fortune list of largest corporations in the. Cheapest home insurance company. Progressive. Average annual premium for $, dwelling coverage. $1, Colorado. Cheapest home insurance company. Grange. Explore Progressive's editorial standards for Answers articles to find out why you can trust the insurance information you find here. Progressive Insurance. USAA's average homeowners insurance rate is around $ per month while Progressive comes in slightly cheaper at about $ per month. Similar to auto insurance. Westfield and Erie are the best home insurance companies based on rates, customer complaints, discounts and coverage offerings. Progressive and Nationwide. Progressive makes it easy and affordable to bundle home and auto insurance and save with one company. When you bundle with us, you'll earn a multi-policy. Progressive homeowners policies in Florida had an average monthly price of $ or $ for an annual policy in *Read the. Progressive home insurance costs an annual average of $, or $61 per month, according to an analysis by our insurance experts. Thanks to these low rates. How much is homeowners insurance in California? Progressive homeowners policies in California had an average cost per month of $ or $1, for an. Progressive Home Insurance now lives at lu-st.ru Log into your policy, see property insurance offerings, and more over at lu-st.ru · Report a. Long story short--Progressive is keeping MY $ It would cost me multiples of that amount to try to collect it through court or even setting up an estate for. According to the latest rankings, Progressive insurance is placed at number 13 with an overall rating of three out of five stars. From customer experiences. Progressive Home® policies bought through independent agents and brokers are provided and serviced by insurers affiliated with Progressive. Each insurer is. Through an agent · Get a quote · Or, call Learn more about home insurance policies. Verdict. Progressive is one of the most suitable options for homeowners insurance. Other than its affordability, the insurer offers a variety of easy-to-use.

How To Report Cryptocurrency On Tax Return

The IRS requires a summary statement for any investment that wasn't reported on a Form B. You may use your crypto Form as your summary statement. If you misreported your crypto taxes, you'd have to file Form X, Amended US Individual Income Tax Return;. Crypto tax tools like CoinTracking make it easy. According to IRS Notice –21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D and Form No sale, no tax? Not so fast. If you received crypto as income, you do need to report it as income, even if you didn't sell it. If you own cryptocurrency but haven't sold or traded it you don't need to report income on your return. You may need to file form T and will need to report. How do I pay taxes on crypto? Report capital gains or losses on your tax return using Form and Schedule D. How are NFTs taxed? NFTs are. A Form B is used to report the disposal of taxpayer capital assets to the IRS. Traditional financial brokerages provide B Forms to customers, but. The short answer is no: If you're a US citizen or green card holder, or even a visitor on a visa, you'll still need to report cryptocurrency no matter where you. If you earned more than $ in crypto, we're required to report your transactions to the IRS as “miscellaneous income,” using Form MISC — and so are you. The IRS requires a summary statement for any investment that wasn't reported on a Form B. You may use your crypto Form as your summary statement. If you misreported your crypto taxes, you'd have to file Form X, Amended US Individual Income Tax Return;. Crypto tax tools like CoinTracking make it easy. According to IRS Notice –21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D and Form No sale, no tax? Not so fast. If you received crypto as income, you do need to report it as income, even if you didn't sell it. If you own cryptocurrency but haven't sold or traded it you don't need to report income on your return. You may need to file form T and will need to report. How do I pay taxes on crypto? Report capital gains or losses on your tax return using Form and Schedule D. How are NFTs taxed? NFTs are. A Form B is used to report the disposal of taxpayer capital assets to the IRS. Traditional financial brokerages provide B Forms to customers, but. The short answer is no: If you're a US citizen or green card holder, or even a visitor on a visa, you'll still need to report cryptocurrency no matter where you. If you earned more than $ in crypto, we're required to report your transactions to the IRS as “miscellaneous income,” using Form MISC — and so are you.

Reporting Cryptocurrency Transactions to the IRS: A Step-by-Step Guide. Any cryptocurrency gain, loss, disposition, or income-triggering event must be reported. In order to report your crypto taxes accurately to the HMRC, you will need to fill out two forms: the HMRC Self-Assessment Tax Return SA form (for income. The IRS requires you to indicate on your tax return if you engaged in certain transactions involving digital assets during If you enter a crypto sale in. Do You Need to Report Stolen or Lost Crypto to the IRS? Let's start with the basics: Do you even need to report stolen or lost cryptocurrency on your taxes? The. Cryptocurrency income is considered taxable by the IRS. Learn how to report income from cryptocurrency such as Bitcoin, Ethereum, and Dogecoin. If you realize gain when you sell a stock, that is a taxable event. The same holds true when you sell cryptocurrency. As a result, if you have failed to report. In , the IRS introduced a mandatory check box on Form U.S. Individual Income Tax Return that requires U.S. taxpayers to answer “yes” or “no” to whether. One way to make it easier to report income is to receive the payment in crypto and then exchange the cryptocurrency into dollars. You can then report your. What to Do When You Forget to Report Cryptocurrency on Your Tax Return · IRS Form – This form is for reporting your capital gains and losses from crypto. It's up to you, the taxpayer, to prove the amount of tax that you owe (or don't owe). You need to report each of your cryptocurrency transactions for the tax. Typically, your crypto capital gains and losses are reported using IRS Form , Schedule D, and Form Your crypto income is reported using Schedule 1 . Both the reporting and payment deadline is April 15, The US tax year is from January 1 to December Your crypto taxes are due by April 15, Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form When answered “Yes,” the IRS would look for a Form filed by the taxpayer to report capital gain/loss for virtual currency transactions. How do I file my. Under current law, the cryptocurrency owner is responsible for reporting all transactions to the IRS. "You're not going to get a Form from the currency. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. Report this as revenue on your business tax return, such as Schedule C if done as a sole proprietor or the appropriate form for an LLC or C-corp. This includes. Coinpanda makes it easy to generate your Bitcoin and crypto tax reports Free tax forms Download IRS Form and Schedule D instantly. How to report cryptocurrency on your taxes · Capital gains are reported on Schedule D (Form ). · Gains classified as income are reported on Schedules C and SE. Crypto exchanges are required to file a K for clients with more than transactions and more than $20, in trading during the year. Crypto tax rates.

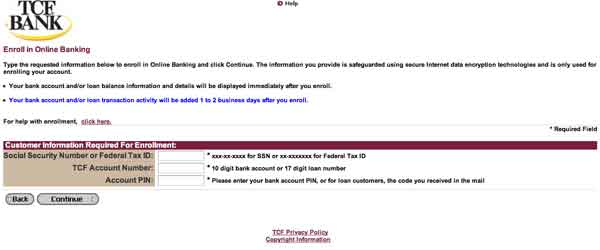

Tcf Bank Open Checking Account

TCF checking account requires a minimum initial deposit of $ TCF Premier 62+ Checking Minimums. Description. Minimum Daily Balance to Avoid Monthly Fee. Open a checking account online or in-branch with Huntington. Explore 4 checking account options and account benefits to help you reach your financial goals. To open a TCF checking account, you'll need to make a $25 deposit. After that, though, there's no minimum monthly balance required, and you'll pay no monthly. bank or credit union where you already have a bank account. Open Bank; Opportunity Bank of Montana; OptimumBank; Orange Bank & Trust Company; Origin Bank. Minimum deposit to open. $ $50 ; Minimum balance. no minimum balance. $5, minimum to avoid a low monthly fee of $6 ; Transaction limit. 1, FREE monthly. Stop by to get started with opening an account or applying for a loan. Keep in mind, you also can manage your accounts anytime through Online and Mobile Banking. Premium Accounts: TCF Premier Checking, TCF Premier Checking Plus. Minimum Deposit. Needed to Open Account. $ $ $ for Basic Accounts for Special. After giving her the 40 dollars to open the account I signed the aggrement papers and everything. When I was married we had separate checking accounts the. A TCF Premier Checking account has some extra features: Earn interest by maintaining a minimum balance in your account; $ minimum opening deposit; TCF Debit. TCF checking account requires a minimum initial deposit of $ TCF Premier 62+ Checking Minimums. Description. Minimum Daily Balance to Avoid Monthly Fee. Open a checking account online or in-branch with Huntington. Explore 4 checking account options and account benefits to help you reach your financial goals. To open a TCF checking account, you'll need to make a $25 deposit. After that, though, there's no minimum monthly balance required, and you'll pay no monthly. bank or credit union where you already have a bank account. Open Bank; Opportunity Bank of Montana; OptimumBank; Orange Bank & Trust Company; Origin Bank. Minimum deposit to open. $ $50 ; Minimum balance. no minimum balance. $5, minimum to avoid a low monthly fee of $6 ; Transaction limit. 1, FREE monthly. Stop by to get started with opening an account or applying for a loan. Keep in mind, you also can manage your accounts anytime through Online and Mobile Banking. Premium Accounts: TCF Premier Checking, TCF Premier Checking Plus. Minimum Deposit. Needed to Open Account. $ $ $ for Basic Accounts for Special. After giving her the 40 dollars to open the account I signed the aggrement papers and everything. When I was married we had separate checking accounts the. A TCF Premier Checking account has some extra features: Earn interest by maintaining a minimum balance in your account; $ minimum opening deposit; TCF Debit.

Why Wait? · Personal Checking, Savings, or Money Market · Credit Card · Mortgage or Equity Loan · Certificate of Deposit (CD), Health Savings Account (HSA), or. Answer: Your account and routing numbers changed as of October 12, We sent you a letter with your new deposit account and routing number(s). They are also. To open a TCF checking account, you'll need to make a $25 deposit. After that, though, there's no minimum monthly balance required, and you'll pay no monthly. PSA for everyone who had a TCF Free Student Checking Account: It is now $5/month for accounts less than $5, at Huntington Bank. My TCF. PSA for everyone who had a TCF Free Student Checking Account: It is now $5/month for accounts less than $5, at Huntington Bank. My TCF. Premium Accounts: TCF Premier Checking, TCF Premier Checking Plus. Minimum Deposit. Needed to Open Account. $ $ $ for Basic Accounts for Special. With a focus on customer satisfaction and convenience, TCF Bank provides traditional banking products such as checking accounts, savings accounts, and loans. Minimum $25 to open a personal non-interest bearing checking account. Referring customer's TCF account must be in good standing. $25 cash will be credited into. A bank that wants and listens to your input to make your entire banking experience better and make it okay to open a checking account. Surprising. We are a Southern Maine credit union promoting financial wellness. Join us for checking, savings, loans and helpful financial information. From home mortgages to business loans, online and mobile banking, to Simply-Free Checking, our TC Federal Bank team is here to help you succeed no matter the. Enjoy 24/7 account access to check balances, pay bills, transfer money, and much more. It's free, convenient and easy to use with security monitoring and 24/7. open the account for you." She never apologized for the I switched from TCF checking to Chase checking and savings account and have not looked back. TCF Financial Corporation, an acronym for Twin City Federal, was a bank holding company based in Detroit, Michigan. Its operating subsidiary, TCF Bank. Banks With Free Checking · Free Notary · Exterminator · Retirement Homes. Filters. Yelp · Financial Services · Tcf Bank account bonus when you join. Great. Simple Basic Account! Guaranteed to never be charged an overdraft or NSF fee. There is NO Opt-In Option! TCF Bank offers personal checking and savings accounts, business checking and savings accounts and much more. We're open to all. Anyone can write a. Download the Huntington mobile app. Check balances, deposit checks, and pay bills; Tap into powerful insights and features; Set up personalized account alerts. Open a checking account with TCF and say hello to convenience banking with easy access to your money. Learn More. TCF Savings Account. TCF Savings Accounts. The company's bank locations are open 12 hours a day, seven days a week, TCF Check Cards and TCF Express Trade Discount Brokerage service.

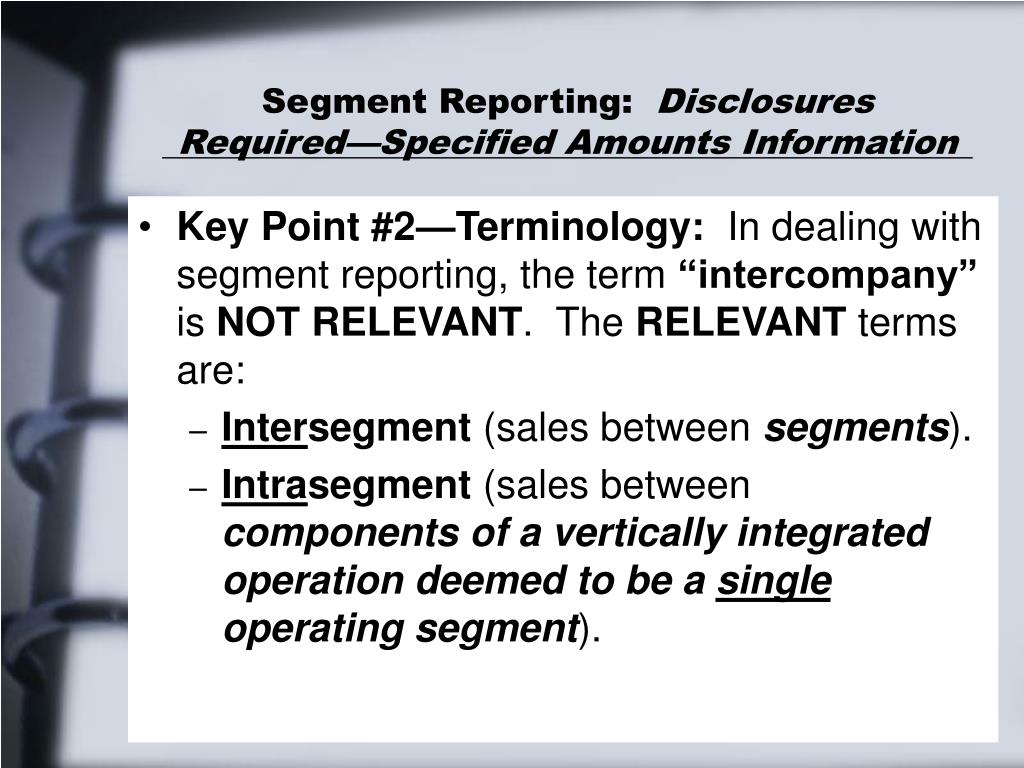

Segment Reporting Requirements

Segment disclosure is not required for an activity whose only outstanding debt is conduit debt for which the government has no obligation beyond the resources. The EA Segment Report consists of five sections: Identification, Mappings, Performance, Transition Planning, and Collaboration and Reuse. This table summarizes. An operating segment needs to meet only one of the 10 percent tests in ASC to be a reportable segment, although it may meet more than one. After identifying. Reporting Requirements · A description of the basis of measurement of segment revenue and segment result. · A reconciliation of the total of the reportable. Therefore, enterprises can provide segment information based on products and services, geographic location, legal entity, customer type, or another basis as. This course provides an overview of the accounting and reporting requirements with respect to segment reporting. The accounting and reporting guidance. Segment reporting is a way to determine different income and expense parts of a business. It dives deeper into different sections of a business. than 75 per cent of the entity's revenue, additional operating segments shall be identified as reportable segments (even if they do not meet the criteria in. IFRS 8 Operating Segments requires particular classes of entities (essentially those with publicly traded securities) to disclose information about their. Segment disclosure is not required for an activity whose only outstanding debt is conduit debt for which the government has no obligation beyond the resources. The EA Segment Report consists of five sections: Identification, Mappings, Performance, Transition Planning, and Collaboration and Reuse. This table summarizes. An operating segment needs to meet only one of the 10 percent tests in ASC to be a reportable segment, although it may meet more than one. After identifying. Reporting Requirements · A description of the basis of measurement of segment revenue and segment result. · A reconciliation of the total of the reportable. Therefore, enterprises can provide segment information based on products and services, geographic location, legal entity, customer type, or another basis as. This course provides an overview of the accounting and reporting requirements with respect to segment reporting. The accounting and reporting guidance. Segment reporting is a way to determine different income and expense parts of a business. It dives deeper into different sections of a business. than 75 per cent of the entity's revenue, additional operating segments shall be identified as reportable segments (even if they do not meet the criteria in. IFRS 8 Operating Segments requires particular classes of entities (essentially those with publicly traded securities) to disclose information about their.

Guidance for segment reporting under the accounting requirements stated in ASC

Segment reporting disclosures are addressed by IPSAS Segment Reporting segments (section 3) and segment disclosure requirements (section 4). Key. This course provides a general overview of the accounting and reporting requirements with respect to segment reporting. New Segment Reporting Webinar. Apr 2, • PM PDT Intel technologies may require enabled hardware, software or service activation. Paragraphs 14–19 specify other situations in which separate information about an operating segment shall be reported. Aggregation criteria. Operating. Latest edition: We explain the amendments (ASU ) to segment reporting in detail, providing examples and analysis. They are the segments identified above, alternatively an aggregation of two or more of those segments where the aggregation criteria (discussed below) are met. According to AS, segment reporting should cover 75% or more of the total revenue of the enterprise. The segments could be business segment or geographic. Our FRD publication on segment reporting has been updated to further enhance and clarify our interpretive guidance. This course provides a general overview of the accounting and reporting requirements with respect to segment reporting. The accounting and reporting. Accounting document from Strayer University, 3 pages, Good Evening Professor and Classmates, Please respond to the following: Segment information is. If a segment covers at least 10% of the entity's profit or loss, 10% of its assets, or 10% of its revenues, it must be reported. If your reported segments. 2. The requirements of this Standard are also applicable in case of consolidated financial statements. 3. An enterprise should comply with the requirements of. Significant segment expenses · Multiple measures of segment profit or loss · Single reportable segment entities · Interim reporting requirements · SEC comment. Current US GAAP and IFRS require that companies report segment information in a manner that is consistent with the way that management organizes the firm. HKAS 14 did not require disclosure of interest income and expense. IN18 The HKFRS requires an entity, including an entity with a single reportable segment, to. This release explains the new reporting requirements. II. RULE CHANGES A. Operating Segment Disclosure SFAS No. 14 required, and the Commission's rules and. The FASB began work in on a project to enhance the disclosure requirements for reporting segments. The objective was to improve. This course provides an overview of the accounting and reporting requirements with respect to segment reporting. The accounting and reporting guidance. Currently, more than countries require or permit the use of International Financial Reporting. Standards (IFRS), with a significant number of countries. Other Requirements. If the total of external revenue reported by operating segments constitutes less than 75% of total consolidated revenues, additional.

How To Add Points To Credit Score Fast

Another way to improve your utilization rate is to request an increase to your credit limits as it that instantly increases your available. Even if you tuck the card away, those monthly transactions and on-time payments should help you on your journey to a good credit score. 5. Increase your credit. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. 5 tips for improving your credit score · Make your payments on time every month. · Keep your credit card balances as low as you can. · Don't cancel all your cards. Another quick way to improve your score is to make payments every two weeks instead of once a month. The increased payments method helps reduce your credit. Below, Select details how you can quickly raise your credit limit — and potentially your credit score — by simply updating your income information with your. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. · Check your credit report · Pay your bills on time. Add in debt repayment as part of your budget (see point 12), and work to minimize what you owe so you can maximize your credit score. 4. Pay bills on time every. Raise your credit score points or more by boosting your payment history, increasing your credit mix, and managing your amounts owed. Another way to improve your utilization rate is to request an increase to your credit limits as it that instantly increases your available. Even if you tuck the card away, those monthly transactions and on-time payments should help you on your journey to a good credit score. 5. Increase your credit. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. 5 tips for improving your credit score · Make your payments on time every month. · Keep your credit card balances as low as you can. · Don't cancel all your cards. Another quick way to improve your score is to make payments every two weeks instead of once a month. The increased payments method helps reduce your credit. Below, Select details how you can quickly raise your credit limit — and potentially your credit score — by simply updating your income information with your. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. · Check your credit report · Pay your bills on time. Add in debt repayment as part of your budget (see point 12), and work to minimize what you owe so you can maximize your credit score. 4. Pay bills on time every. Raise your credit score points or more by boosting your payment history, increasing your credit mix, and managing your amounts owed.

Lenders may use one of your credit scores to help them decide whether or not to approve you for a loan. The higher the score, the greater the chance you'll. Another quick way to improve your score is to make payments every two weeks instead of once a month. The increased payments method helps reduce your credit. Pay off debt. The lower your balances are, the lower your credit utilization will be. Ask for a credit limit increase. A higher limit means lower utilization. How To Raise Your Credit Score Fast How long will it take to increase your credit score? · 1. Find Out When Your Issuer Reports Payment History · 2. Pay Down. Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an increase to your credit limit. Paying off debt isn't the only way to improve your credit utilization. You can also try to increase your credit limits. Most credit card companies have a form. By limiting your products, knowing what's up with your credit, making your payments on time and keeping your balance low, your credit score can go up, up, up. When you connect your bank or credit card, we'll look for bills with positive history that you can add to your Experian credit file. It could also instantly. This can knock your credit score down by 5 to 10 points each time it occurs and remain on your credit report for two years (though the negative impact will. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close. Assuming you make all your payments on time, etc. If you pay off most of your credit card debt, whenever your score refreshes the next month, it. Adding another line of credit to your credit mix can improve your score. Grow just works. 1. Get set up with your. There are a few ways to improve your credit utilization, including paying off your balances. A credit limit increase might also help, as long as you use your. The best way might be to add tradelinees which are authorized user credit cards. Tradelines could boost your credit score 50– points in 2–4. Keep Balances Low. Maxing out your credit cards can negatively affect your credit scores. Light use of your cards is best. The less you charge, the better. Adding another element to the current mix helps your score as long as you make on-time payments. Quick Loan Shopping. If you have bad credit and can't find. You can optimize this by adjusting both variables; you can spend less, and you can open new credit accounts or ask for increases on your existing credit limits. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New.

Customize Citibank Debit Card

Making Credit Card Payments. Make credit card payments online. Learn more >. Meijer Credit Card is issued by Citibank, N.A.. The Meijer Mastercard is Mastercard is a registered trademark, and the circles design is a trademark of. A tiny chip embedded in your card protects your personal information by converting it to a unique code, making access extra difficult for fraudsters. Open an account with Citi. Visit lu-st.ru to set up your login information and security authentication. This will require you to enter the last four. M posts. Discover videos related to Citi Double Cash Card Vs Custom Cash on TikTok. See more videos about Uo Incentivized Program, inside of A Positive. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. With the Citi Custom Cash® Card, earn 5% cash back rewards on your highest monthly spend category in each billing cycle, and 1% on everything else. Call from the phone number associated with your account to activate your debit card and set a PIN. MasterCard® Automatic Billing Updater. Your new card will arrive in a generic envelope before your current card expires. If you've already received your card, activate your card via the Citi. Making Credit Card Payments. Make credit card payments online. Learn more >. Meijer Credit Card is issued by Citibank, N.A.. The Meijer Mastercard is Mastercard is a registered trademark, and the circles design is a trademark of. A tiny chip embedded in your card protects your personal information by converting it to a unique code, making access extra difficult for fraudsters. Open an account with Citi. Visit lu-st.ru to set up your login information and security authentication. This will require you to enter the last four. M posts. Discover videos related to Citi Double Cash Card Vs Custom Cash on TikTok. See more videos about Uo Incentivized Program, inside of A Positive. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. With the Citi Custom Cash® Card, earn 5% cash back rewards on your highest monthly spend category in each billing cycle, and 1% on everything else. Call from the phone number associated with your account to activate your debit card and set a PIN. MasterCard® Automatic Billing Updater. Your new card will arrive in a generic envelope before your current card expires. If you've already received your card, activate your card via the Citi.

Check out our credit card skin selection for the very best in unique or custom, handmade pieces from our stickers shops. Manage your Best Buy credit card account online, any time, using any device. Submit an application for a Best Buy credit card now. The no-annual-fee card offers 5% cash back on purchases in a top eligible spend category up to the first $ spent each billing cycle. If you have the Citigold® Account or the Citi Priority Account, you can withdraw up to $2, per day from a Citi ATM. If you have any other Citi account, your. 1 Please call Citi Customer Service on the back of your debit card to request a new card with a preferred first name on it. OR; 2 Request to update your. Make purchases with your debit card, and bank from almost anywhere by phone Get more from a personalized relationship offering no everyday banking. Citi Custom Cash® Card. Apply Now · Learn More. 5% |or 1%Cash Back. Earn 5% cash Bank U.S. in the Citigold® Private Client International, Citigold. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Top Credit Cards for Purchasing Gas · American Express Blue Cash Preferred Card · Bank of America Customized Cash Rewards Credit Card · Citi Premier Card · PenFed. You can also open a new checking account with Citi by calling (TTY: we accept or other Relay Service) or visiting a branch. Show your personality or support your local school with Gate City Bank's custom debit card cards! Order online, or stop by any convenient location near you. For your account security, avoid using a public or shared computer when inputting your ATM, Debit, or Credit Card number or other sensitive information. Citi will only issue one Citi Custom Cash® Card account per person. Rates How to find a No Fee ATM Machine? 4 Best Quick Loans for Emergency Cash. Use your Visa® Card with Apple Pay and Google Pay for added speed, security and convenience when making purchases in-store, in-app and online Group People. CITY Visa Electron Debit Card - By your side, round the clock. Now comes the Visa Debit Card from City Bank. Your life, therefore, becomes hassle-free. card design fintech fun ui ui design Magic credit card bank bank card card citibank credit creditcard dreams flamingo gifts iilustration mastercard photoshop. Customize transaction controls: Companies can customize and preset authorization parameters as needed for each transaction. • Safeguard against fraud: Virtual. OneUnited Bank card with two hands making a heart shape. Introducing. The OneLove Card. A New Chapter in Financial Empowerment. At OneUnited Bank, we celebrate. card and your time. Get around faster in an intuitive, clutter-free environment. Log in from anywhere with a design optimized for any device. Manage your.

How To Get A Used Car Home

Consumers should be aware that motor vehicle laws differ for used cars and buyers do not have the same protections as when purchasing from a licensed dealer. Buying a Used Car? Have These Important Items On Hand · Saying Goodbye to Your Old Car? Keep These Documents · Buy Used and Buy Confidently · See Our Full Pre-. You can search for registered Automotive Dealers by using the “Find a DMV-regulated Business” service. When you buy a used vehicle, the dealer must certify, in. If you intend to purchase a used vehicle, the. Secretary of State strongly urges you to utilize an online national database, such as Carfax, and. purchase of new and used cars handled by a licensed dealer. For used car buyers only: Option to Cancel – The buyer may purchase a 2-day sales contract. It's important to consider not only the size and performance of vehicles you're considering, but also their fuel economy, safety ratings, and cost to insure. Buying a car out of state from a private seller requires you to personally verify and handle all the documentation requirements that a dealership would. Autotrader advises potential buyers get a mechanical inspection whenever buying a used car from a private party or dealership. Although the buyer pays for. Finance contract lease agreement. If you're purchasing a used vehicle, the dealer must show you the previous owner's title. Examine the title carefully. The. Consumers should be aware that motor vehicle laws differ for used cars and buyers do not have the same protections as when purchasing from a licensed dealer. Buying a Used Car? Have These Important Items On Hand · Saying Goodbye to Your Old Car? Keep These Documents · Buy Used and Buy Confidently · See Our Full Pre-. You can search for registered Automotive Dealers by using the “Find a DMV-regulated Business” service. When you buy a used vehicle, the dealer must certify, in. If you intend to purchase a used vehicle, the. Secretary of State strongly urges you to utilize an online national database, such as Carfax, and. purchase of new and used cars handled by a licensed dealer. For used car buyers only: Option to Cancel – The buyer may purchase a 2-day sales contract. It's important to consider not only the size and performance of vehicles you're considering, but also their fuel economy, safety ratings, and cost to insure. Buying a car out of state from a private seller requires you to personally verify and handle all the documentation requirements that a dealership would. Autotrader advises potential buyers get a mechanical inspection whenever buying a used car from a private party or dealership. Although the buyer pays for. Finance contract lease agreement. If you're purchasing a used vehicle, the dealer must show you the previous owner's title. Examine the title carefully. The.

A pre-purchase inspection by a professional is good practice for just about any used car buy, even if the car is sitting right in front of you. A vehicle. Consumers should be aware that motor vehicle laws differ for used cars and buyers do not have the same protections as when purchasing from a licensed dealer. You can apply for registration on the same form used for the title application. If you already have a Pennsylvania registration plate, an authorized PennDOT. In some cases, you may be able to drive your new vehicle home from the dealership the same day you purchase it. At other times, you may have to arrange pickup. Get a vehicle history report at lu-st.ru, take a test drive, and have an independent mechanic check the car. If the dealer won't let you, walk away. Used vehicles are not required to have a warranty. Federal law requires all dealers to post a Buyers Guide in the window of each vehicle they offer for sale. Used Vehicle Purchased Out-of-State – A buyer must receive either a properly Their customers often get saddled with damaged, dangerous, or. Before buying a used car from a private party, have a trusted mechanic check that the vehicle is in good working order. The mechanic may help you estimate the. When you find the Car You Want · Read and understand the warranty – it may be full, limited or “as-is.” An “as-is” warranty means you have no warranty at all. For vehicles less than 7 years old, purchased from someone other than a dealer, accompanied by a notarized bill of sale, the tax is 6% of the greater of the. Used cars can be purchased at places other than dealerships. Private sellers advertise in the classified sections of city, regional and neighborhood newspapers. You cannot legally drive your new vehicle if it is not properly registered. Usually, when you buy a used car from a dealership such as Auto Simple, the dealer. Used car buying tips · Inspect the car yourself for mechanical soundness, or have it inspected by a certified mechanic. · Buy a vehicle report from an independent. HomeConsumer + MoneyCars & getting aroundCar sales & repairsBuying a used car: Be careful. Buying a used car: Be careful. Feature image - Buying a used car. An often overlooked consideration when shopping for a used car is car insurance. Once you have an idea of the vehicle you want to purchase, it's good to speak. If considering a car from a private seller, use common sense. We can't stress this enough when buying a car from a stranger. Ask the seller to meet at a safe. You've found the perfect car and you're ready to buy. What do you need to bring with you to the dealership to make sure you can take your new vehicle home right. Buying and Selling · A bill of sale that identifies the vehicle by year, make and VIN and shows the time and date of sale and is signed by both the buyer and the. Can you drive a car off the lot the same day? · Limiting your search to local dealerships and whatever they have in stock · Having cash on hand to pay for the. If you are not looking to purchase a new car during a sales event, or are looking to purchase a used car, check financing rates with your bank or credit union.

1 2 3 4 5 6